Agencia Tributaria

Screenshot

Description

Content

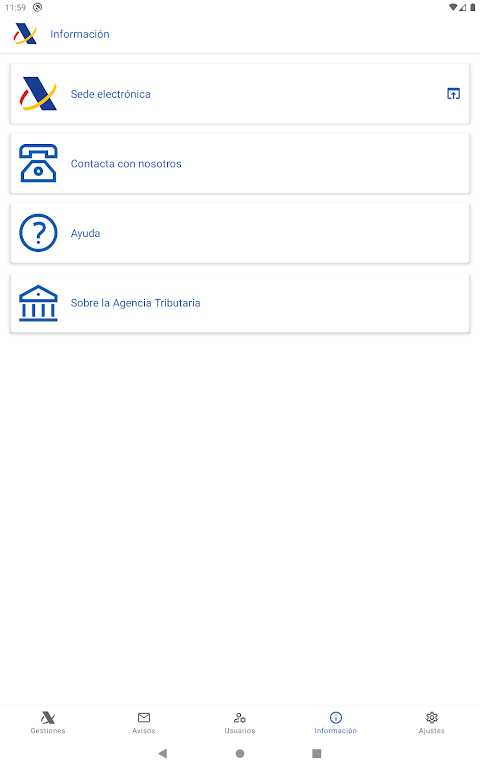

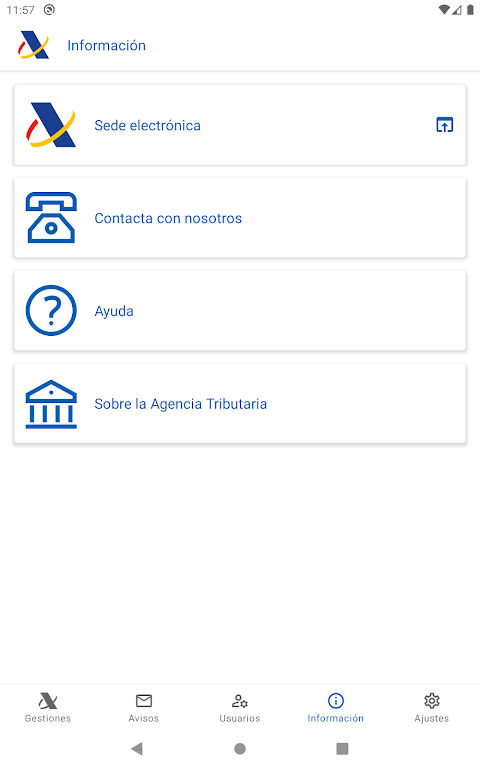

The Tax Agency makes available to citizens, free of charge, an application for smart mobile devices (smartphones and tablets) that offers the possibility of carrying out procedures and receiving personal notifications and news easily, safely and without having to travel.

Digital identity management is offered based on the Reference number, Cl@ve or electronic certificate (software or by NFC with the electronic DNI).

The procedures that are available from the APP are those of Rent, prior appointment, pay defer and consult debts, notifications and comparison of documents, virtual assistance tools, access to a previously agreed video call, census data and tax address, subscription to informative notices , subscriptions and auction property search, document signing and consultation of signed documents.

It offers access to information and the possibility of receiving notices of new information and personal notices.

Users provide personal data to log in, identify the device and to allow the Tax Agency to provide personalized services within the scope of its powers, for which interaction with its own servers is required, for which the Tax Agency informs users that this information will be available to your mobile application. These data will be used exclusively for the purposes of compliance with your tax rights and obligations and will not be transferred to third parties, except in those cases that comply with article 95.1 of the General Tax Law.

It also provides in the APP a section with a legally valid privacy notice, as well as ensures the corresponding protection of personal data. Part of this information is stored or sent to the servers of the Tax Agency, always to the domains of which it is the owner (https://www1.agenciatributaria.gob.es, https://www2.agenciatributaria.gob.es , https://www6.agenciatributaria.gob.es, https://www9.agenciatributaria.gob.es, https://www12.agenciatributaria.gob.es, https://www*.agenciatributaria.gob.es) . Likewise, the Tax Agency guarantees that personal information will be stored and used in a sufficiently secure manner, for the time necessary and only to provide you with the personalized services described above.

You can consult the privacy policy (https://sede.agenciatributaria.gob.es/Sede/avisolegalApp.shtml), the terms of service (https://sede.agenciatributaria.gob.es/Sede/terminosservicioappaeat.html) and the accessibility statement (https://sede.agenciatributaria.gob.es/Sede/accesibilidadApp.shtml) also in the APP.

Agencia Tributaria, a Spanish government agency responsible for tax collection and customs administration, is a complex and multifaceted organization. Its primary function is to ensure compliance with the country's tax laws, maximizing revenue collection while upholding fairness and transparency.

Structure and Responsibilities

Agencia Tributaria is organized into various departments and units, each with specific responsibilities:

* Tax Collection: Enforces tax laws, processes tax returns, and collects taxes from individuals and businesses.

* Customs Administration: Oversees the movement of goods across borders, collecting customs duties and ensuring compliance with import and export regulations.

* Tax Audits and Inspections: Conducts audits and inspections to verify tax compliance and detect potential fraud.

* Taxpayer Assistance: Provides guidance and support to taxpayers, answering inquiries and resolving tax-related issues.

* Research and Analysis: Studies tax policies, conducts economic analysis, and develops recommendations for tax reforms.

Tax Compliance and Enforcement

Agencia Tributaria employs a range of measures to ensure tax compliance:

* Electronic Tax Filing: Mandates the electronic filing of tax returns, simplifying the process and reducing errors.

* Data Analysis and Risk Management: Utilizes advanced data analytics to identify potential tax risks and target non-compliant taxpayers.

* Penalties and Fines: Imposes penalties and fines for non-compliance, ranging from late payment fees to criminal prosecution.

Customer Service and Taxpayer Rights

Agencia Tributaria recognizes the importance of taxpayer rights and provides various avenues for assistance:

* Online Services: Offers a comprehensive online platform where taxpayers can access tax information, file returns, and communicate with the agency.

* Telephone and Email Support: Provides phone and email support to assist taxpayers with their queries and concerns.

* Taxpayer Charter: Outlines the rights and obligations of taxpayers, ensuring fair and transparent treatment.

Modernization and Innovation

Agencia Tributaria is committed to modernization and innovation to enhance efficiency and improve taxpayer services:

* Artificial Intelligence (AI): Leverages AI to automate processes, detect fraud, and provide personalized taxpayer support.

* Blockchain Technology: Explores the use of blockchain to improve the security and transparency of tax transactions.

* Data Analytics: Utilizes data analytics to gain insights into taxpayer behavior and identify areas for improvement.

International Cooperation

Agencia Tributaria collaborates with international tax authorities to combat tax evasion and promote global tax transparency:

* Tax Information Exchange Agreements (TIEAs): Enters into agreements with other countries to exchange tax information and assist in tax investigations.

* Multilateral Convention on Mutual Administrative Assistance in Tax Matters: Participates in international efforts to enhance tax cooperation and combat tax avoidance.

Impact on Spanish Economy

Agencia Tributaria plays a crucial role in the Spanish economy:

* Revenue Generation: Collects a significant portion of the government's revenue, funding essential public services.

* Tax Fairness: Ensures equitable tax distribution, reducing tax evasion and promoting a level playing field for businesses.

* Economic Stability: Contributes to economic stability by ensuring a steady flow of tax revenue for government spending.

Conclusion

Agencia Tributaria is a highly effective and sophisticated tax administration agency that safeguards the Spanish tax system and contributes to the country's economic well-being. Its commitment to compliance, taxpayer assistance, modernization, and international cooperation positions it as a leader in the field of tax administration.

Information

Version

8.20

Release date

May 28 2024

File size

80.95 MB

Category

Productivity

Requires Android

8.1.0+ (Oreo)

Developer

Agencia Tributaria

Installs

1

ID

es.aeat.dgc.mobile

Available on