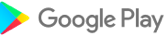

EY Tax Briefing

Screenshot

Description

Content

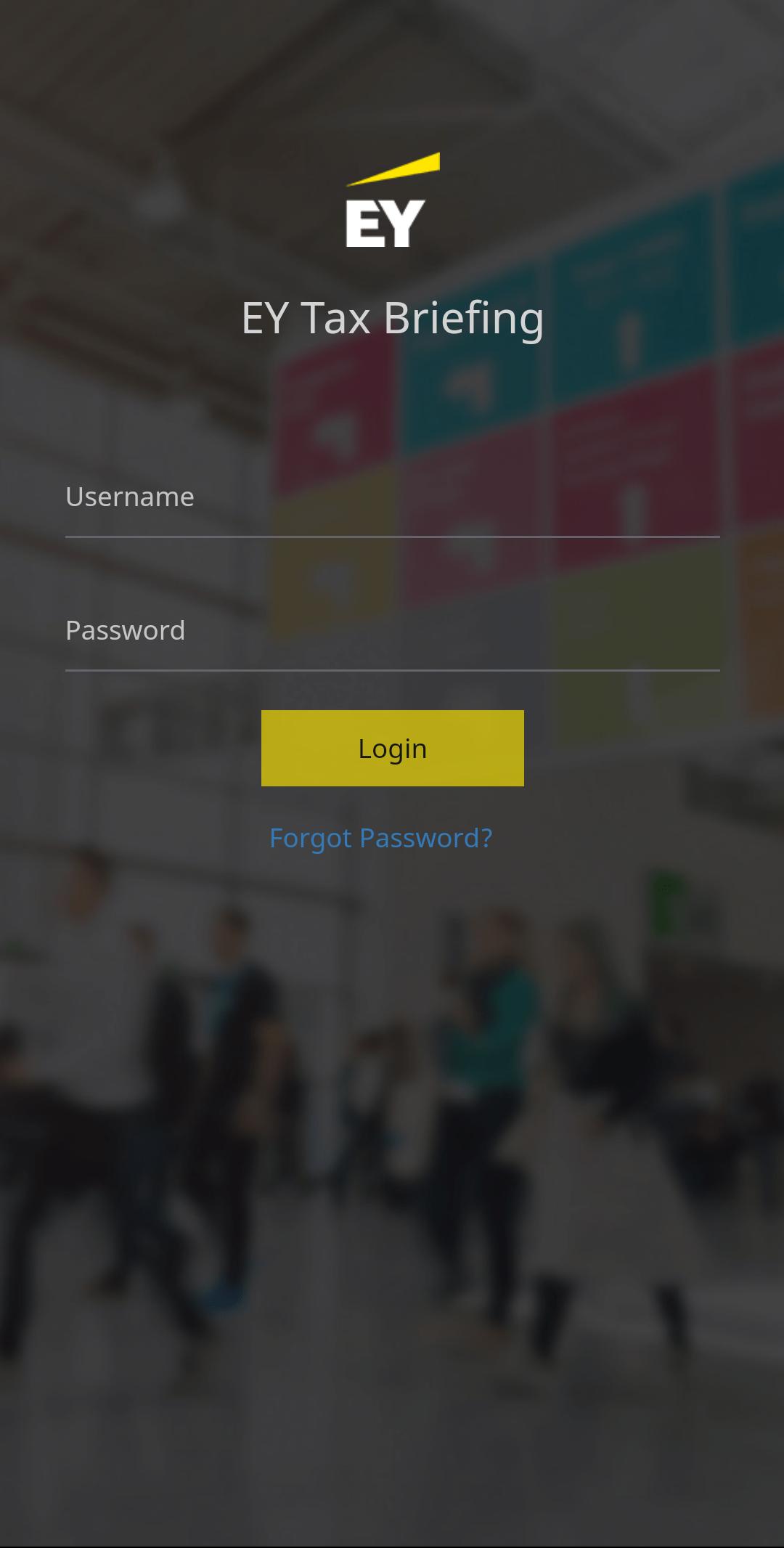

Allows international assignees to complete their EY tax briefing tasks at ease.

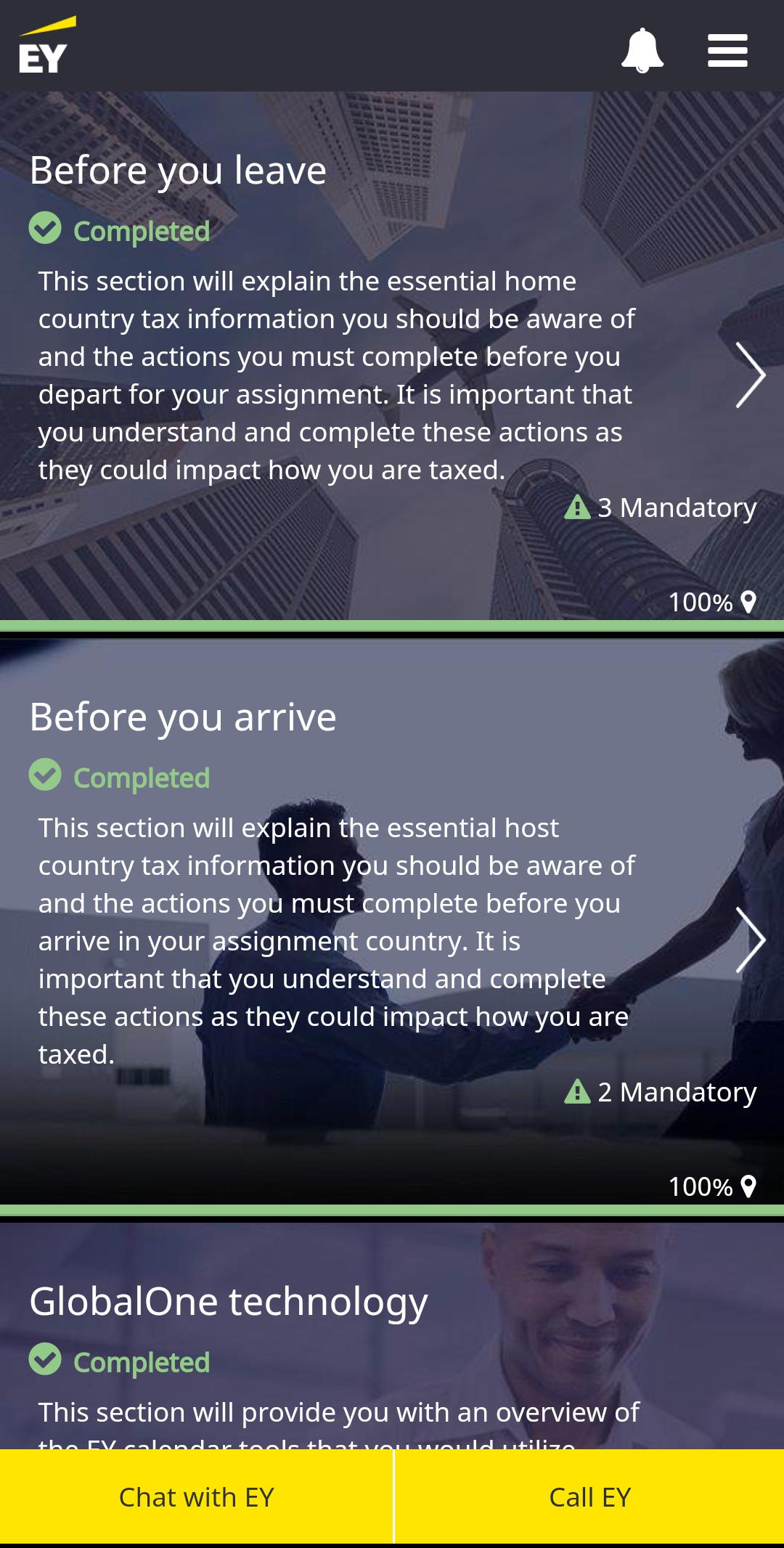

EY Tax Briefing is a mobile application that allows international assignees to complete their EY tax briefing tasks at ease, so that you can concentrate on your assignment. You can access useful videos and documents, and track your tax briefing activities:

- Before you leave for your assignment

- Before you arrive at your assignment location

- During your tax briefing

- Overview of tax return process

- Overview of tax settlement process

The application sends you reminders of your tax briefing milestones and allows you to book an appointment with your dedicated EY tax contact or obtain answers to your questions via the online chat feature.

What's New in the Latest Version 1.4.0

Last updated on Jul 16, 2024

Bug Fixing

EY Tax BriefingEY Tax Briefing is a comprehensive resource for tax professionals, providing up-to-date information on the latest tax laws, regulations, and accounting standards. The briefing covers a wide range of topics, including:

* Federal income taxation

* State and local taxation

* International taxation

* Tax accounting

* Tax planning

The briefing is written by a team of experienced tax professionals who provide clear and concise explanations of complex tax issues. The briefing is also updated regularly to ensure that it reflects the latest changes in the tax laws.

Content

The EY Tax Briefing is divided into several sections, each of which covers a different area of taxation. The sections are:

* Federal Income Taxation: This section covers the federal income tax laws, including the individual income tax, the corporate income tax, and the estate and gift tax.

* State and Local Taxation: This section covers the state and local tax laws, including the sales tax, the property tax, and the income tax.

* International Taxation: This section covers the international tax laws, including the foreign tax credit, the controlled foreign corporation rules, and the transfer pricing rules.

* Tax Accounting: This section covers the tax accounting rules, including the accrual method of accounting, the cash method of accounting, and the installment method of accounting.

* Tax Planning: This section covers tax planning strategies, including retirement planning, estate planning, and business planning.

Audience

The EY Tax Briefing is intended for a wide range of tax professionals, including:

* Accountants

* Attorneys

* Tax preparers

* Financial planners

* Business owners

The briefing is also a valuable resource for students who are studying taxation.

Benefits

The EY Tax Briefing provides a number of benefits to tax professionals, including:

* Up-to-date information on the latest tax laws, regulations, and accounting standards

* Clear and concise explanations of complex tax issues

* Practical guidance on tax planning and compliance

* A convenient and easy-to-use resource

The EY Tax Briefing is an essential resource for tax professionals who need to stay up-to-date on the latest tax laws and regulations. The briefing is also a valuable resource for students who are studying taxation.

Information

Version

1.4.0

Release date

Jul 16 2024

File size

9.9 MB

Category

Business

Requires Android

Android 7.0+

Developer

Talal Dawelneem

Installs

1K+

ID

com.ey.eytaxbriefing

Available on