NPS by Protean (NSDL e-Gov)

Screenshot

Description

Content

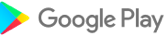

The new APP gives your details of Subscribers account online.

The Subscriber can access latest account details as is available on the CRA web site using user ID (PRAN) and password.

The APP access your account details online and provides you with user friendly interface to browse through your account information.

It also enables you to maintain your latest contact details and password.

The APP gives better user experience and provides additional functionality such as

1.

View current holdings

2.

Request for Transaction Statement for the year on your email ID.

3.

Submit Contribution for Tier I / Tier II

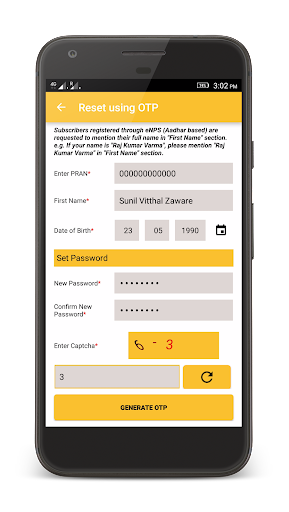

4.

Change Scheme Preference

5.

Initiate withdrawal from Tier II account

6.

View your Account details.

7.

Download e-PRAN

8.

Inquiry/ raise Grievance

9.

View Last 5 contribution transactions carried out

10.

Change contact details like Telephone, Mobile no.

and email ID.

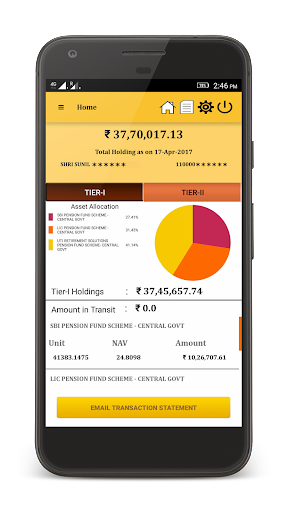

11.

Change your Password / Secret Question

12.

Regenerate password using secret Question/ OTP

13.

Get notifications related to NPS.

Overview

NPS, an acronym for National Pension System, is a government-sponsored pension scheme in India designed to provide retirement benefits to citizens.

Protean, a technology service provider, is responsible for developing and managing the NPS system on behalf of the National Securities Depository Limited (NSDL e-Gov).

Features

* Tax Benefits: NPS offers tax deductions under Section 80C and 80CCD(1B) of the Income Tax Act.

* Investment Options: Subscribers can choose from a range of investment options, including equity funds, corporate bonds, and government securities.

* Flexibility: NPS provides flexibility in terms of contribution amounts and withdrawal options.

* Transparency: All transactions and account statements are available online for easy tracking.

* Security: NPS accounts are secure and regulated by the Pension Fund Regulatory and Development Authority (PFRDA).

Eligibility

* Indian citizens between 18 and 65 years of age

* Non-Resident Indians (NRIs) with valid Indian passports

Registration

* Registration can be done online through the NPS website or through designated Points of Presence (POPs).

* Subscribers need to provide personal details, contact information, and bank account details.

* A Permanent Retirement Account Number (PRAN) is issued to each subscriber.

Contributions

* Subscribers can contribute to their NPS accounts on a regular or one-time basis.

* Minimum annual contribution is Rs.

6,000 for Tier 1 account and Rs.

2,000 for Tier 2 account.

* Employer contributions are also eligible for tax benefits.

Withdrawal

* Subscribers can withdraw up to 60% of their accumulated corpus tax-free upon reaching 60 years of age.

* The remaining 40% must be used to purchase an annuity that provides regular income during retirement.

* Partial withdrawals are also allowed for specific purposes, such as medical emergencies or higher education.

Benefits

* Retirement Security: NPS provides a secure and stable source of income during retirement.

* Tax Savings: Subscribers can save significantly on taxes through tax deductions and tax-free withdrawals.

* Investment Diversification: NPS offers a range of investment options to cater to different risk appetites.

* Government Guarantee: The Government of India guarantees a minimum return on the Tier 1 account.

* Convenience: NPS is easily accessible online and through POPs.

Conclusion

NPS is a comprehensive pension scheme that offers numerous benefits to subscribers.

It provides tax savings, investment diversification, and a secure source of income during retirement.

Protean's technology platform ensures a seamless and user-friendly experience for NPS subscribers.

Information

Version

14.0.30

Release date

Jun 20 2016

File size

9.5 MB

Category

Business

Requires Android

9 and up

Developer

Protean eGov Technologies Ltd.

Installs

5M+

ID

nps.nps

Available on